2023 biweekly payroll calculator

We also offer a 2020 version. Administrative employees are paid on the same schedule as the Citys biweekly payroll and pay is calculated in the same way.

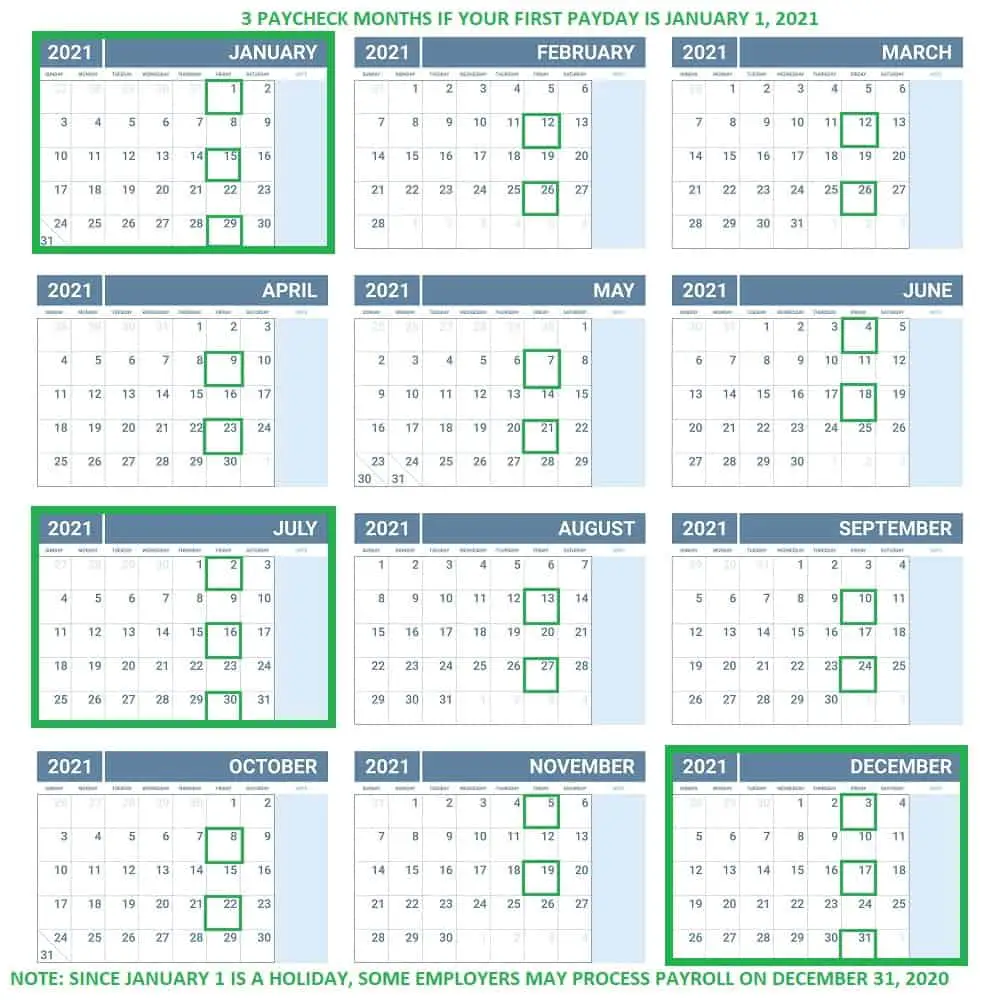

Here Are The 3 Paycheck Months For 2021 Michael Saves

2022-2023 Benefits View the benefits offered by Garland ISD and FFGA.

. He suggests no more than 20000. Work Study allows a student the potential to earn a specified sum of money by turning in biweekly time sheets for the hours that you have worked. To secure a work study position youll need to read the hiring instructions and then apply online.

Refer to the GSAs federal Domestic Maximum Per Diem Rates effective Oct. QuickBooks Payroll powered by KeyPay. So you can plan your payroll accordingly - whether its a biweekly pay schedule.

If you need a free timesheet template that will let you record clock inout times try a professionally designed timesheet calculator listed below. 2023 Biweekly Pay Schedule. Baruch College One Bernard Baruch Way 55 Lexington Avenue at 24th Street New York NY 10010 646-312-1000.

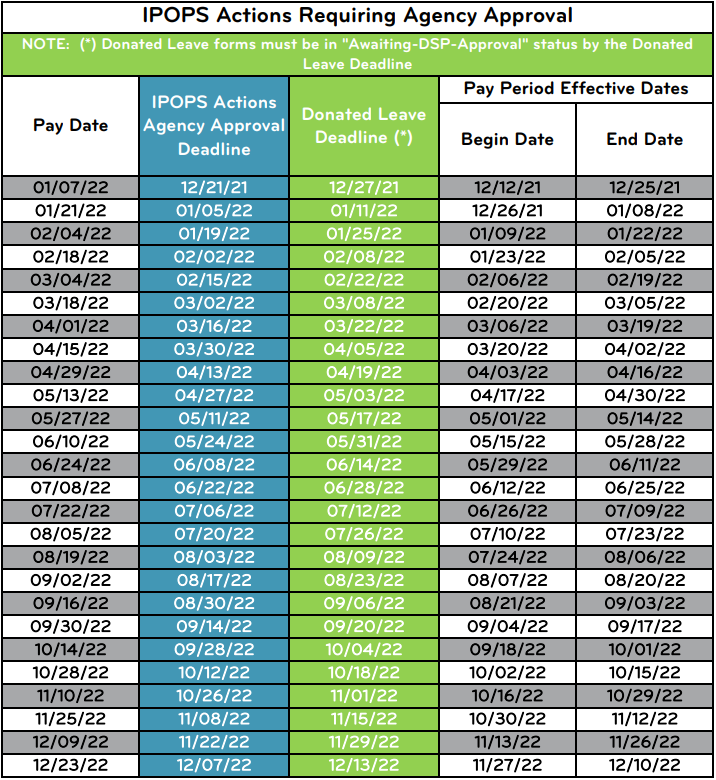

Payroll Please select Full Year under the month drop down list if you would like a snapshot of Pay Schedules and Pay-dates for the whole year. Required Forms and. The GISD Payroll Benefits Department in coordination with third-party supplemental plan administrator First Financial FFGA is committed to providing district employees with benefits and resources to meet a variety of healthcare and retirement needs.

Form W-2 Sample Wage and Tax Statement. Please note this calculator is for the 2022 tax year which is due in April 17 2023. Payroll Register Reports and Processes.

If you compute payroll manually your employee has submitted a Form W-4 for 2020 or later and you prefer to use the Wage Bracket method use the worksheet below and the Wage Bracket Method tables that follow to figure federal income tax withholding. Students are limited to only one work study position. Use this simplified payroll deductions calculator to help you determine your net paycheck.

December 10 2021 40804 PM PST. If the city is not listed but the county is listed use the daily rate of the county. - Federal taxes are calculated using tables from IRS Publication 15.

In the event of a conflict between the information from the Pay Rate Calculator and. Email protected Complete HR Directory. For example fiscal year 2023 begins July 1 2022 and ends June 30 2023.

Lopatin also warns that a line of credit can be an addictive. Domain rentals south australia us coin dealers online signs she doesn t love herself science of reading conference 2022 2023 medieval history time period l7 operations manager amazon salary 2003 bmw 325i pros and cons married at. Which Way Should You Extract Your Home Equity.

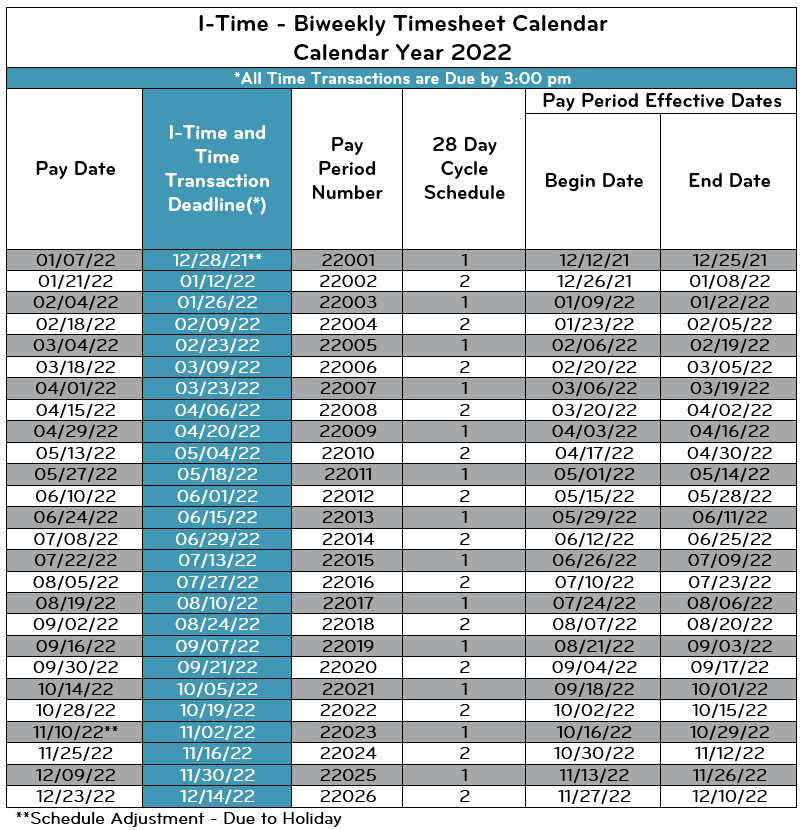

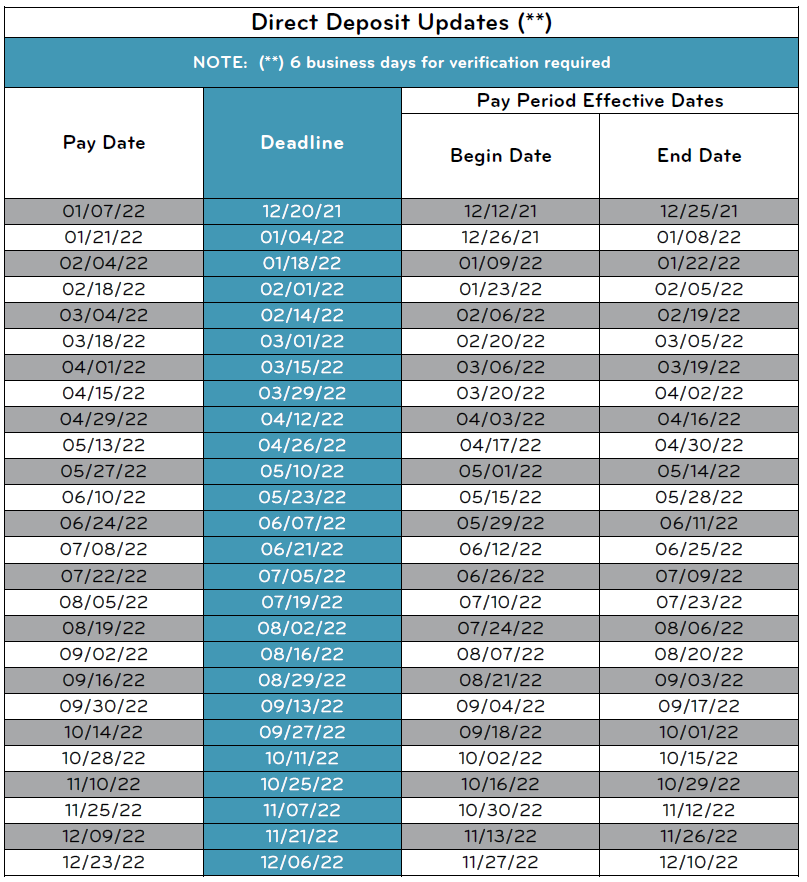

2021 Form W-2 and Form 1042-S Information. Try out our pay rate calculator. 2022 Biweekly Ecotime Deadline Schedule.

Traditional CDs are a simple way to invest generally with higher interest rates than other savings options. Payout Timelines for Compensatory and Overtime. Please call your specifically designated Payroll HR Point of Contact.

- FICA Social Security Tax and Medicare are calculated based on the percentage of your. To a maximum of 5000. Fiscal year 2023 is not a leap year.

Section 210 of the Taxpayer Certainty and Disaster Tax Relief Act of 2020 provides for the temporary allowance of a 100 business meal deduction for food or beverages provided by a restaurant and paid or incurred after December 31 2020 and before January 1 2023. 2022 Ecotime Deadline Schedule. HISTORICAL PAY PERIODS TIMEKEEPING DEADLINE 230 PM CURRENT PAY PERIOD.

This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA. 1040 Tax Estimation Calculator for 2022 Taxes. Announcement regarding Enhanced Payroll Register Process.

Main HR Phone Line. Payroll Timekeeping Deadline Schedule. You can refer to the pay calendar and also use the pay rate calculator to.

If you feel that a payment is inaccurate contact Payroll Services. Tax law changes for 2022. Payroll Service Requests Adjustments Reversals and Retry Process.

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Refer a Friend and You Could Earn up to 500. - Enter your Gross Pay for monthly semi-monthly biweekly or weekly pay periods.

Enter your filing status income deductions and credits and we will estimate your total taxes. Access payroll information. Fiscal Year 2023 beginning July 1 2022 is not a leap year.

Pricing Framework for Australian Public Hospital Services 202324 open for public consultation News 8 Jun 2022 IHPA releases National Efficient Price and National Efficient Cost Determinations for 202223 23 Mar 2022. The Citys payroll system is based on the fiscal year covering the period July 1 through June 30. Mileage calculation provided by the Australia Taxation Office - 78 cents per kilometre from 1 July 2022 for the 2022-2023 income year.

Justin Lopatin who serves as vice president of mortgage lending for PERL Mortgage suggests a HELOC would be best in circumstances where the homeowner wants to borrow a small amount and repay it quickly. Ecotime Campus Campus Ecotime Deadline. You do the math.

Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later. We work with departments to identify and assist with workforce issues including a renewed emphasis on performance management and standardized discipline policies employee development and knowledge transfer ongoing evaluation of workplace rules and implementation of workforce metrics to measure and analyze overtime utilization absenteeism appeals. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS.

Get 2022 and 2023 for 21800. Simply smarter team time project tracking. Below are the other contact resources.

Find promotional CD rates in your area by entering your zip code below. Download timesheets and other payroll-related templates for Excel OpenOffice and Google SheetsThe Vertex42 timesheets and timecards contain multiple versions within a single workbook allowing you to choose weekly or bi-weekly or different methods for entering times decimal vs. When you tell your friends about First Merchants and they open a new First Merchants Personal Checking Account or Auto Loan you could earn up to 500 a year when referring multiple friends.

How to make a timesheet in Excel. The Pay Rate Calculator is not a substitute for pay calculations in the Payroll Management System. In-State or Out-of-State Meals and Lodging.

A time sheet template isnt really meant to be the cure to all of your time management problems but if you are looking for a very simple low-cost timesheet system or want to create your own blank printable timesheet. Screenshots Terms Conditions Sample Printout. Using the Paycheck Calculator - Use the worksheet corresponding to the W-4 form old 2019 or older.

3 Paycheck Months In 2022 What To Do With The Extra Paycheck To Improve Your Finances My Money Planet

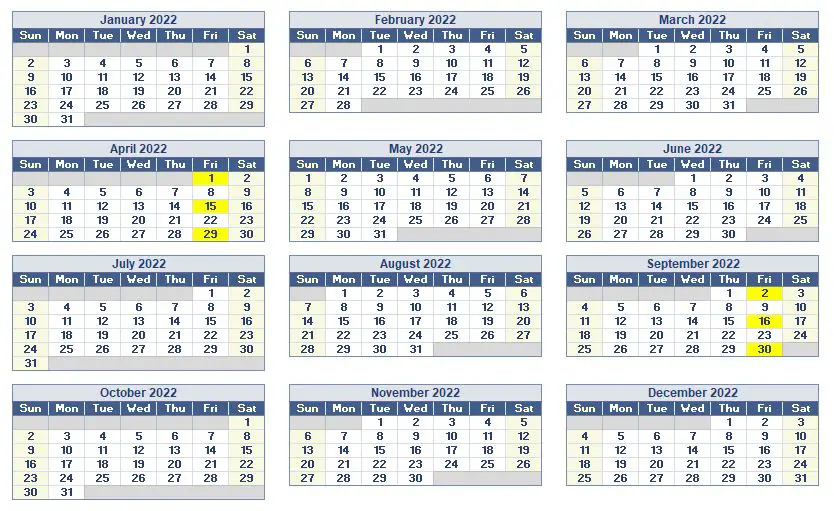

Biweekly Calendars 2022

1

2

2022 Biweekly Payroll Calendar Template For Small Businesses Hourly Inc

The Pros And Cons Biweekly Vs Semimonthly Payroll

1

Biweekly Calendars 2022

I Just Downloaded A Simple Free 2023 Biweekly Payroll Calendar For Excel And Google Sheets From Tipsographic Payroll Calendar Payroll Calendar

The 3 Paycheck Months In 2022 What To Do With Your Third Paychecks

1

Bi Weekly Schedule Template Luxury 7 Biweekly Payroll Calendar 2015 Template Payroll Calendar Payroll Calendar Template

Free Printable Excel 2022 Biweekly Payroll Calendar Download A Professionally Designed Bi Weekly Payroll Schedule Payroll Calendar Calendar Download Payroll

2

Biweekly Calendars 2022

1

Bi Weekly Schedule Template Luxury 7 Biweekly Payroll Calendar 2015 Template Payroll Calendar Payroll Calendar Template